nebraska tax withholding calculator

You must also match this tax. Pay Period 04 2022.

Income Tax Results Made You Sick It S Time For A Checkup American Church Group Nebraska

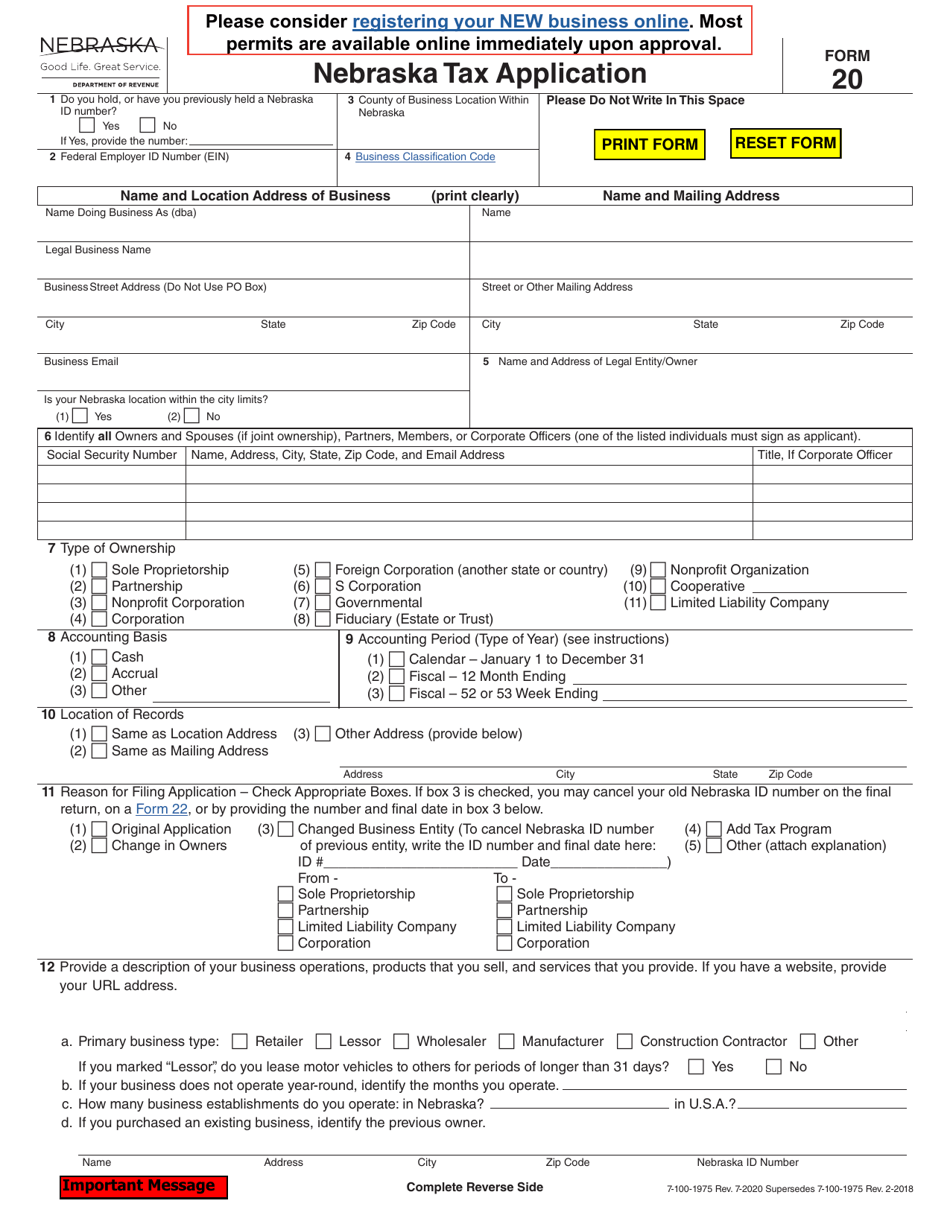

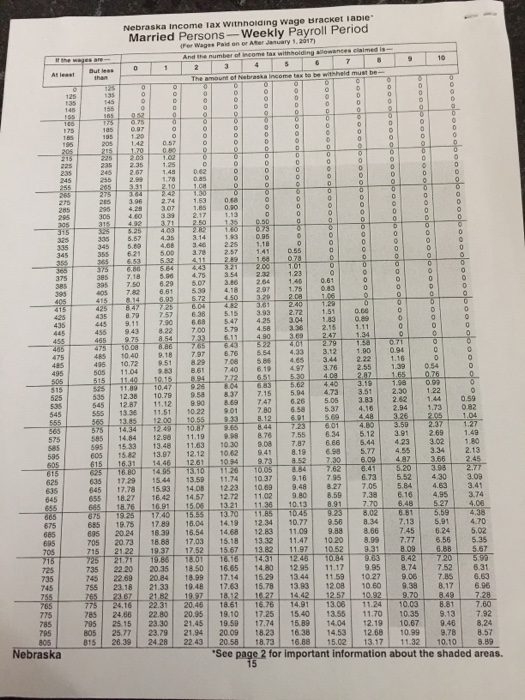

Usually you can calculate Nebraska payroll income tax withholdings in the following ways.

. TAXES 22-08 Nebraska State Income Tax Withholding. Its a progressive system which means that taxpayers who earn more pay higher taxes. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

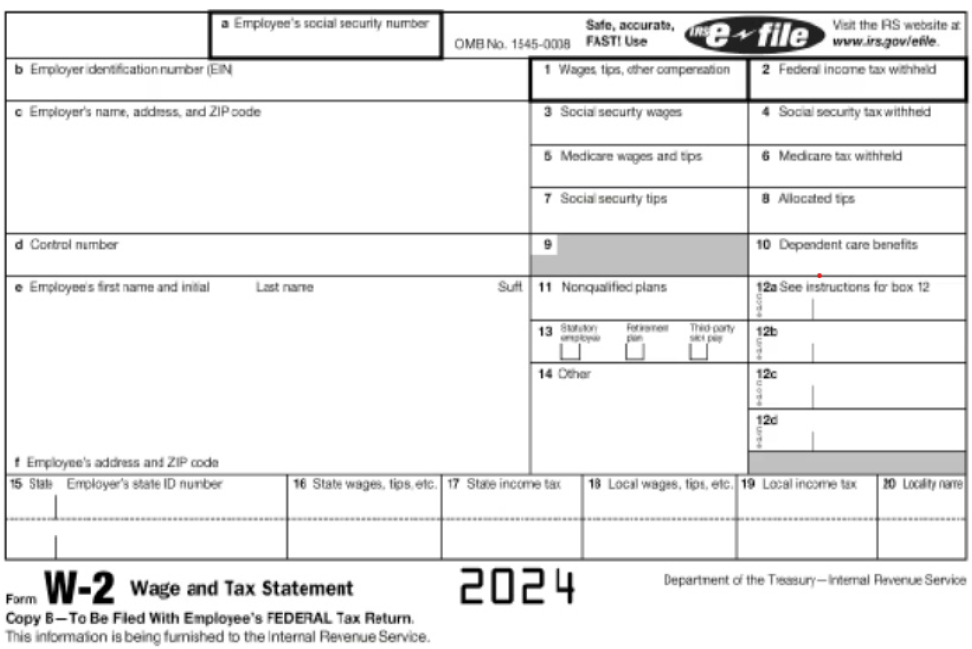

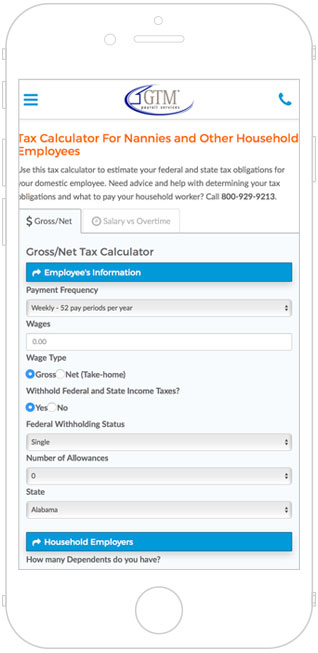

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories. Nebraska income tax calculator 2021.

2021 2022 Federal and Nebraska Payroll Withholding General Information. Payroll check calculator is updated for payroll year 2022 and new W4. Tax Calculators Tools.

The first deduction that all taxpayers face is fica taxes. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in a given calendar year.

The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES. The Nebraska income tax. 2022 W-4 Help for Sections 2 3 and 4.

Nebraskas state income tax system is similar to the federal system. Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska. The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

The State of Nebraska has introduced a State Form W-4N to claim marital status and exemptions for State withholding purposes effective January 1 2020. W-4 Form Basic -. Form W-4 Tax Withholding.

The income tax withholdings for the State of. Calculate Nebraska state tax manually by using the state tax tables Use payroll software to. March 7 2022 Effective.

The Federal or IRS Taxes Are Listed. There are four tax brackets in. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

Free Federal and Nebraska Paycheck Withholding Calculator. What is the income tax rate in Nebraska. The state income tax rate in.

The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37.

Filing My State Of Ne Taxes I M Getting An Error Form Ptc Part B Parcel Id Number The Parcel Id Number Must Be 9 Digits The Id Is 10 Digits Can This

How To Calculate Nebraska Income Tax Withholdings

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Withholding For Pensions And Social Security Sensible Money

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

/cloudfront-us-east-1.images.arcpublishing.com/gray/SOFL3NEDPBOIXKWVX3I5NYJBSM.jpg)

Lincoln City Council Passes 13 Percent Budget Increase

Tax Withholding For Pensions And Social Security Sensible Money

Nanny Tax Payroll Calculator Gtm Payroll Services

How To Start An S Corp In Nebraska Nebraska S Corp Truic

Nebraska Hourly Paycheck Calculator Gusto

State W 4 Form Detailed Withholding Forms By State Chart

Llc Tax Calculator Definitive Small Business Tax Estimator

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Payroll Tools Tax Rates And Resources Paycheckcity

I Really Need Your Help Please Help Me I Need Get Chegg Com