infrastructure investment and jobs act tax provisions

Definition of Capital. The Bipartisan Infrastructure Deal will grow the economy enhance our competitiveness create good jobs and make our economy more sustainable resilient and just.

Highlights Of The Infrastructure Investment And Jobs Act Wheeler Accountants

The Infrastructure Investment and Jobs Act IIJA also known as the Bipartisan Infrastructure Bill and originally in the House as the INVEST in America Act is a United States federal statute enacted by the 117th United States Congress and signed into law by President Joe Biden on November 15 2021.

. The Build Back Better Act is a bill introduced in the 117th Congress to fulfill aspects of President Joe Bidens Build Back Better PlanIt was spun off from the American Jobs Plan alongside the Infrastructure Investment and Jobs Act as a 35 trillion Democratic reconciliation package that included provisions related to climate change and social policy. 3472 Biodiesel Tax Credit Extension Act 10 S1753 Home Energy Savings Act 11 HR. Infrastructure including approximately 550 billion of new federal investments out of about 12 trillion in total.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The Infrastructure Investment and Jobs Act included 550 billion in new funds for roads and bridges clean water high-speed internet access and more. While the investments in the Inflation Reduction Act will help people across the country purchase electric vehicles the Infrastructure Investment and Jobs Act will make charging those vehicles more convenient by providing 75 billion to build out charging infrastructureThese investments will help the United States reach the Biden-Harris.

We estimated it reduced federal revenue by 147 trillion over 10 years before accounting for economic growth. It was the most serious financial crisis since the Great Depression 1929. Highway cost allocation study.

Predatory lending targeting low-income homebuyers excessive risk-taking by global financial institutions and the bursting of the United States. The financial crisis of 20072008 or Global Financial Crisis GFC was a severe worldwide economic crisis that occurred in the early 21st century. It was pro-growth reform significantly lowering marginal tax rates and cost of capital.

Over his term Trump reduced federal taxes and increased federal. The economic policy of the Donald Trump administration was characterized by the individual and corporate tax cuts attempts to repeal the Affordable Care Act Obamacare trade protectionism immigration restriction deregulation focused on the energy and financial sectors and responses to the COVID-19 pandemic. Capital includes cash equipment inventory other tangible property cash equivalents and indebtedness secured by assets owned by the immigrant investor provided the immigrant investor is personally and primarily liable and that the assets of the new commercial.

Between a bipartisan infrastructure bill Infrastructure Investment and Jobs Act IIJA potentially the largest investment in American research and science in decades the CHIPS and Science Act and the historic climate spending contained in the IRA the United States is on the path to a range of technology transitions that could transform our economy to a clean. Transportation Infrastructure and Provisions Related to Public-Private Partnerships. 899 billion in new infrastructure funding and reauthorizations.

In addition CBO estimated savings of 508 billion between 2023 and 2026 for the three-year delay of this rule included in the Infrastructure Investment and Jobs Act. On August 7 the IRA the Senate response to the more ambitious Build Back Better legislation passed by the House. This title extends several highway-related authorizations and tax provisions including.

Human reproduction act expand medical expense tax credit include costs reimbursed surrogate mother ivf expenses forward providing adoptive parents additional weeks leave make sure level support. It will deliver 550 billion of new federal investments in Americas infrastructure over five years touching. The bipartisan Infrastructure Investment and Jobs Act will invest 110 billion of new funds for roads bridges and major projects and reauthorize the surface transportation program for the next.

Among other provisions this bill provides new funding for infrastructure projects including for. The deal will create good. According to the White House the key features of the bill include.

Infrastructure Investment and Jobs Act. The expenditure authority for the Highway Trust Fund through FY2026 the. President Joe Biden signed a 12 trillion infrastructure bill into law Monday.

The IRA is the long-delayed legislative companion of the bipartisan Infrastructure Investment and Jobs Act IIJA the major infrastructure package adopted in November 2021 with significant Republican support in the Senate. This title extends several highway-related authorizations and tax provisions including. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

The Infrastructure Investment and Jobs Act of 2021 IIJA is a federal bill passed by the 117th Congress and signed into law by President Joe Biden D on November 15 2021. The Presidents tax reform proposal. Transportation Infrastructure Finance and Innovation Act of 1998 amendments.

Federal requirements for TIFIA eligibility and project selection. To read the full text of the bill click here. 3456 HOPE for HOMES Act of 2021 12 S975 Securing Americas Clean Fuels Infrastructure Act 13 S986 CCUS Tax Credit Amendment Act 14 S661 Carbon Capture Modernization Act.

Roads bridges and major projects. Roads bridges and major projects. For petitions filed before March 15 2022 For petitions filed on or after March 15 2022.

We have taken strong action and invested over 4 billion in 535 water infrastructure projects including 99 new water plants and 436 plant upgrades. The Tax Cuts and Jobs Act in 2017 overhauled the federal tax code by reforming individual and business taxes. Infrastructure Investment and Jobs Act.

Active transportation infrastructure investment program. The Infrastructure Investment and Jobs Act IIJA signed into law on November 15 2021 authorizes historic investments in US. The expenditure authority for the Highway Trust Fund through FY2026 the.

Among other provisions this bill provides new funding for infrastructure projects including for. The act was initially a 547715 billion infrastructure package that. Moreover the 2017 tax law allows companies to use the taxes they pay in high-tax countries to shield profits in tax havens encouraging offshoring of jobs.

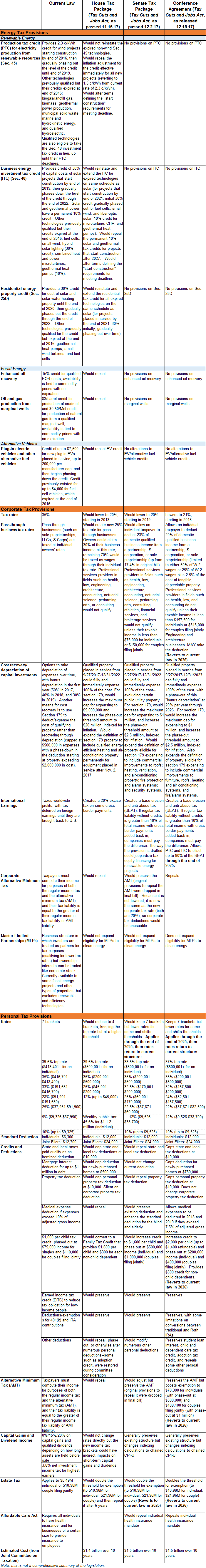

11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for. The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL. TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec.

8 S1806 Biodiesel Tax Credit Extension Act 9 HR.

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Doeren Mayhew Cpas

Infrastructure Bill Ends Ertc For Employers Early Shindelrock

Infrastructure Investment Jobs Act Iannuzzi Manetta

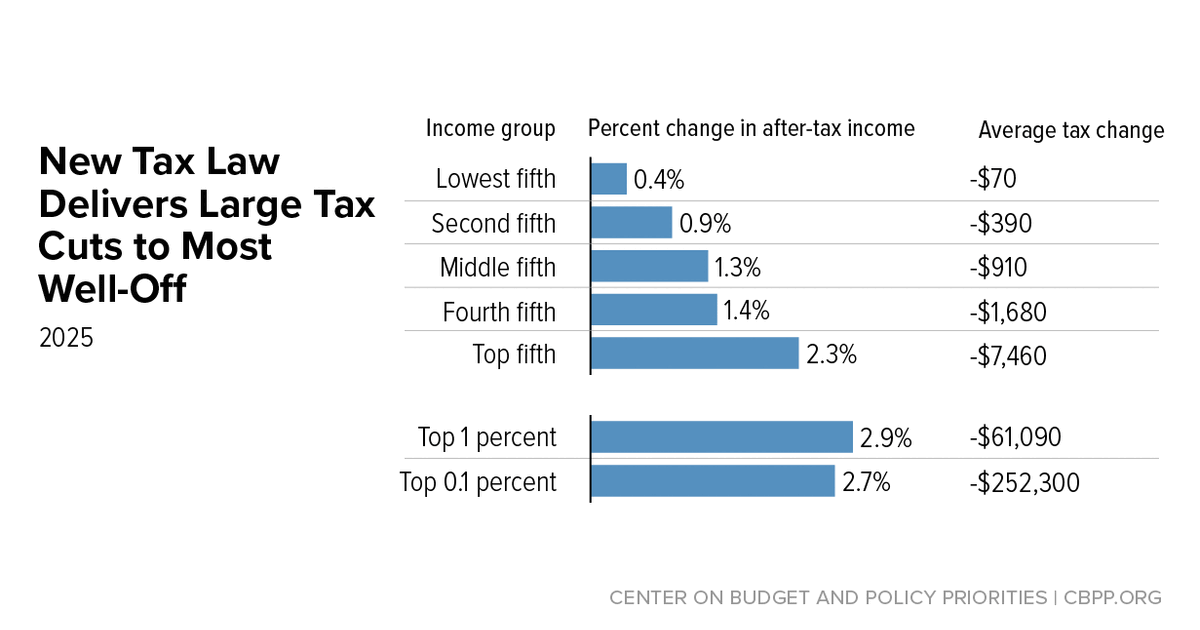

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

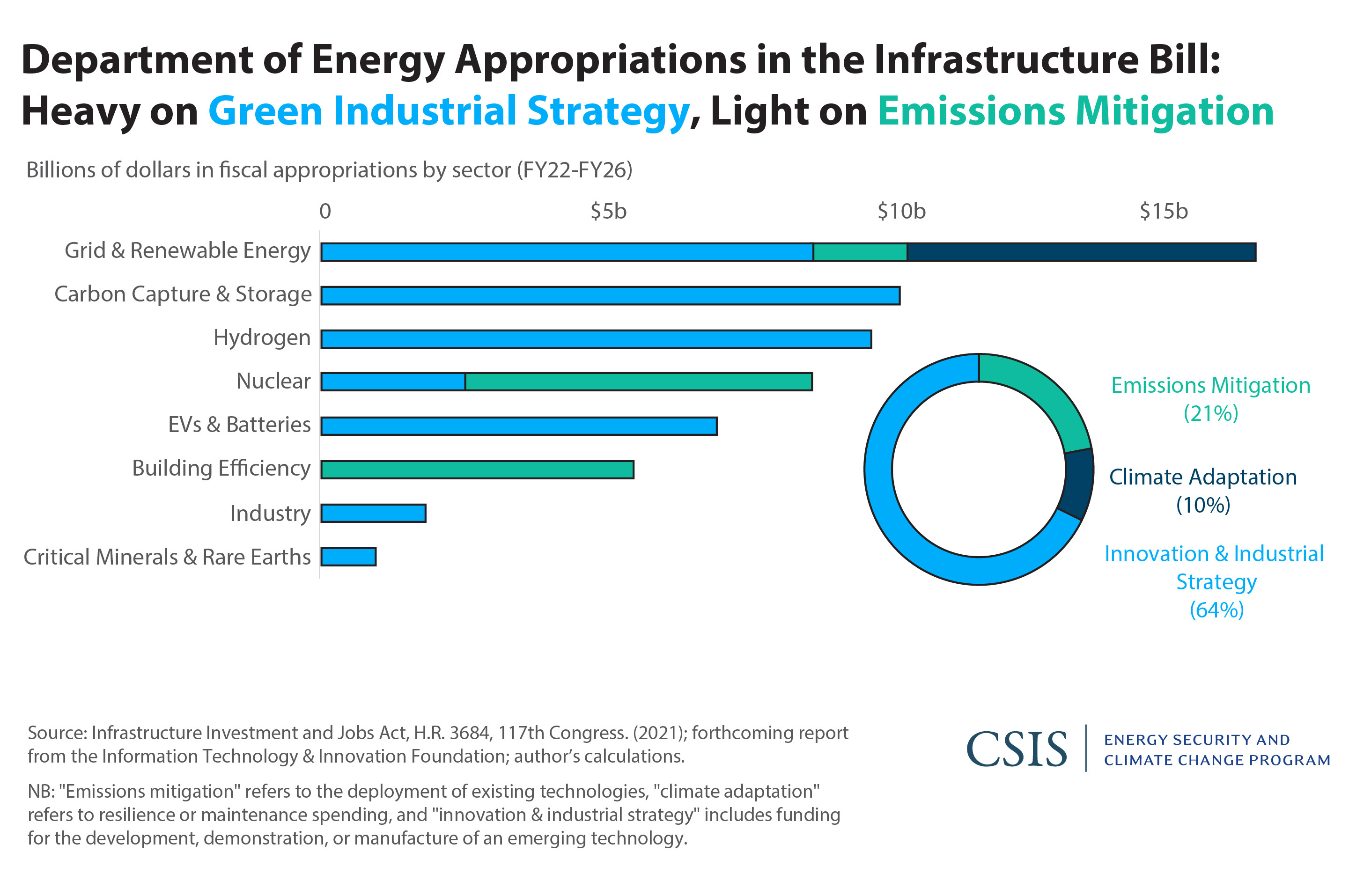

The Infrastructure Investment And Jobs Act Will Do More To Reach 2050 Climate Targets Than Those Of 2030 Center For Strategic And International Studies

Infrastructure Law Terminates The Employee Retention Credit Early Buchbinder Tunick Co

What The Senate Infrastructure Bill Means For Local Governments National League Of Cities

Trump Gop Tax Law Encourages Companies To Move Jobs Offshore And New Tax Cuts Won T Change That Itep

Part Ii Infrastructure Investment And Jobs Act A Guide To Key Energy And Infrastructure Programs And Funding Insights Skadden Arps Slate Meagher Flom Llp

Media Alert The Infrastructure Investment And Jobs Act Passed By Congress Presents Several Implications For Taxpayers To Consider Business Wire

The States Getting The Most Money From The Infrastructure Bill

Infrastructure Investment And Jobs Act Ey Us

Infrastructure Bill Revitalizing And Rebuilding America Issue Two Baker Donelson Jdsupra

Infrastructure Investment And Jobs Act Ey Us

Two Things Crypto Investors Should Know About The Infrastructure Bill Nextadvisor With Time

Infrastructure Investment And Jobs Act Includes Several Tax Provisions With Little Fanfare

All Resources Clean Energy Business Network

Ghj Income Tax Reporting For The Employee Retention Credit

What S In The Inflation Reduction Act And What S Next For Its Consideration Bgr Group