north dakota sales tax on vehicles

Sales or Use Tax Motor Vehicle Excise Tax Titling License and Registration Vehicle Description ars Trucks Vans including new used or rebuilt No Yes - 4 Required Required Exception. The North Dakota 5 percent sales tax and 3 percent rental surcharge are imposed on rentals of motor vehicle for periods less than 30 daysin this state.

What S The Car Sales Tax In Each State Find The Best Car Price

In the state of North Dakota many services are considered to be taxable.

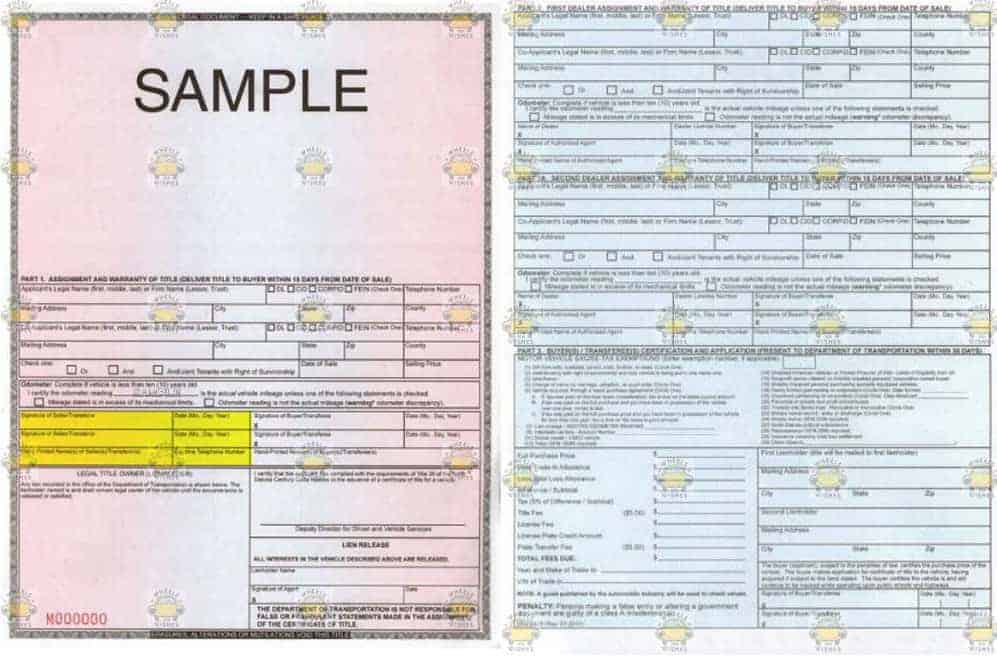

. North Dakota Title Number. Abandoned Disposal fee is 150. Be sure the seller has signed dated and completed Part 1 including the odometer reading if the car is less than 10 years old.

You can find these fees further down on the page. You can find these fees further down on the page. Extra fees may apply in addition to the standard registration fee.

The sales of licensed motor vehicles including trailers and semi-trailers are subject to a motor vehicle excise tax instead of state and local sales taxes. North Dakota has recent rate changes Thu Jul 01 2021. For example transportation services repair services hospital and nursing home services and furnishing services are considered to be taxable and thus you would most.

Vehicles required to be registered in North Dakota must pay a motor vehicle excise tax on the purchase price sales price less any trade-in amount or on the fair market value of the vehicle if not acquired through a purchase. Or the following vehicle information. The 5 percent sales tax and the 3 percent rental surcharge are separate charges with each applying to the rental charges.

Some taxpayers may qualify for a refund on motor vehicle fuel tax. For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in North Dakota. How are trade-ins taxed.

The average local tax rate in North Dakota is 0959 which brings the total average rate to 5959. In North Dakota there are 3 types of motor fuel tax. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND 58104-7535 7012397165.

Do I have to pay sales tax on a used car in North Dakota. For vehicles that are being rented or leased see see taxation of leases and rentals. The sales tax on a used vehicle is 5 in North Dakota.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Any motor vehicle excise use or sales tax paid at the time of purchase will be credited. The yearly fee for a personalized special letter plate in North Dakota is 25.

Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle fuel sold to retailers and consumers. Temporary Registration Fees in North Dakota The following fees do not include the 10 permit fee. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees.

Title transfer fee is 5. When you buy a car in North Dakota be sure to apply for a new registration within 5 days. Tax imposed on motor vehicle lease.

Select the North Dakota city from the list of popular cities below to see its current sales tax rate. For more information and to apply for the. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles.

How can I get a title in my dealership name. Year first registered of the vehicle this will be within one year of the model Shipping or gross weight of the new vehicle required depending on the type of vehicle. Do South Dakota vehicle taxes apply to trade-ins and rebates.

There is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired either in or outside of the state of North Dakota for use on the streets and highways of this state and required to be registered under the laws of this state. The sales tax on a car purchased in North Dakota is 5. The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles.

Alcohol at 7 New farm machinery used exclusively for agriculture production at 3 New mobile homes at 3. With local taxes the total sales tax rate is between 5000 and 8500. License fees are based on the year and weight of the vehicle.

Automobiles pickups and vans purchased to lease to others for 28 days or less are not subject to motor vehicle excise tax. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. 21700 for a 20000 purchase Tioga ND 85 sales tax in Williams County 20900 for a 20000 purchase Bowman ND 45 sales tax in Bowman County.

Vehicles purchase price and the 5 motor vehicle excise tax paid at the time the motor vehicle is titled with the North Dakota Motor Vehicle Department. North Dakota sales tax is comprised of 2 parts. Rental Of Motor Vehicle The North Dakota 5 sales tax and 3 rental surcharge are imposed on rentals of motor vehicles for periods less than 30 days in this state.

North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959. To calculate registration fees online you must have the following information for your vehicle. Motor vehicle fuel includes gasoline and gasohol.

The 5 sales tax and the 3 rental surcharge are separate charges. The sales tax is paid by the purchaser and collected by the seller. If you have a full North Dakota title with last.

However this does not include any potential local or county taxes. In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and plate fees. For example if you are purchasing a used.

North dakota sales tax on vehiclesimmolation nuclear blast. The motor vehicle excise tax must be paid to the North Dakota department of transportations. The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state.

You will need to complete Part 3 of the. If the vehicle was purchased outside of. And registration in this state no credit is allowed for sales tax or motor vehicle excise tax previously paid to such foreign country.

I am a North Dakota dealer and have a title that is completely full. Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied. North Dakota ND Sales Tax Rates by City The state sales tax rate in North Dakota is 5000.

You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the vehicles age and weight. For more information contact the ND DMV at 701 328-2725. Gross receipts tax is applied to sales of.

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tennessee 2020 Passenger Issue This New Baseplate Was Introduced In January 2006 And Replaced All Previous Issues By T License Plate Car Plates Shelby County

Nj Car Sales Tax Everything You Need To Know

North Dakota Vehicle Title Donation Questions

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Lakota Country Times Oglala Lakota County Gets Police Vehicles Native American News Native American Indians Country Time

Infiniti Qx80 Lease Deals Incentives Special Offers Lease Deals Infiniti Usa Infiniti

Form Sd Vehicle Title Transfer

2009 Ford Edge For Sale In Frankfort Il Offerup

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Free North Dakota Motor Vehicle Dmv Bill Of Sale Form Pdf

Car Sales Tax In North Dakota Getjerry Com

Subaru 360 Taxi Owned By M Kindelberger Subaru Subaru Cars Subaru Tribeca

Nhl Toronto Maple Leafs 2 Pc Carpet Car Mat Set 17 X27 Nfl Car Car Mats Car Floor Mats